Land Tax

LAND TAX 1910

Land Tax was established in 1692 and finished in 1963 but most records that survive are between 1780 and 1831 as the assessments were used as the record of qualification to vote. Assessments dated after 1832 are not so useful because the information provided is often incomplete.

Standard forms were introduced for assessments and the following information may be of use to the house historian

A few words of warning about using these records. Names in the tax lists can sometimes be the male head and not connected in any way with family members. It is therefore possible to get the wrong person. For instance if a widow remarried, her property might be listed in the name of her new husband.

Although landowners were liable to pay the tax, in many parishes the tenants may have actually paid the tax and claimed the money back from their landlord in the form of a rebate.

Though a useful source for landownership and occupiers in parishes, the information has to be treated and used with caution Not all landowners or tenants will be recorded and the poorer sub-tenants and labourers will be missing completely

The tax was administered locally and original records will usually be located at the County Record Office

Records are held at the National Archives and also on microfilm and located by searching the FamilySearch Catalog Place search for Great Britain and then look for Board of Inland Revenue – Land Tax Assessments.

Land Tax: Properties are not described in any detail (if at all) and house numbers or names rarely provided although occasionally you can tell from the brief description if the land included buildings #

More information can be found at Family Search

Down load this pdf written by Mark Pearsall, Family History Records Specialist where he discusses the development of Land Tax and the records available at The National Archives

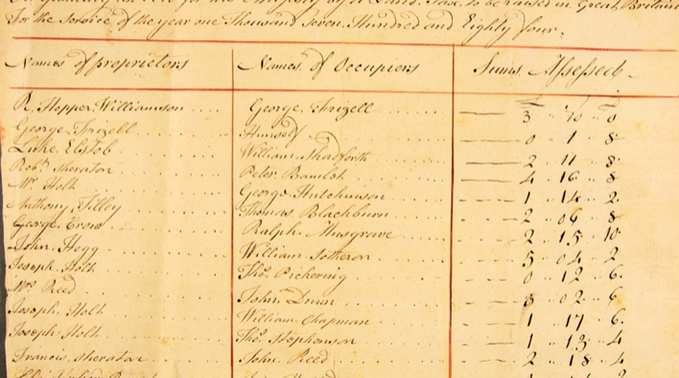

Standard forms were introduced for assessments and the following information may be of use to the house historian

- Rentals:- the annual value of the property where it has been complet

- Names of proprietors and copyholders -: names are often abbreviated and no indication given of residence or profession.

- Names of occupiers:- all tenants may not be specifically mentioned

- Names or description of Estates or Property: - house numbers or street names are rarely provided, property is most commonly described simply as ‘House’ or ‘Land’ although public houses, shops, mills, etc. may be identified.

A few words of warning about using these records. Names in the tax lists can sometimes be the male head and not connected in any way with family members. It is therefore possible to get the wrong person. For instance if a widow remarried, her property might be listed in the name of her new husband.

Although landowners were liable to pay the tax, in many parishes the tenants may have actually paid the tax and claimed the money back from their landlord in the form of a rebate.

Though a useful source for landownership and occupiers in parishes, the information has to be treated and used with caution Not all landowners or tenants will be recorded and the poorer sub-tenants and labourers will be missing completely

The tax was administered locally and original records will usually be located at the County Record Office

Records are held at the National Archives and also on microfilm and located by searching the FamilySearch Catalog Place search for Great Britain and then look for Board of Inland Revenue – Land Tax Assessments.

Land Tax: Properties are not described in any detail (if at all) and house numbers or names rarely provided although occasionally you can tell from the brief description if the land included buildings #

More information can be found at Family Search

Down load this pdf written by Mark Pearsall, Family History Records Specialist where he discusses the development of Land Tax and the records available at The National Archives

The HouseLand Registry

Maps Manorial Records Other Records Postcards & Photos Enclosures Books & House histories Church & Parish Records |

The People |

|

OUR ADVERTISING POLICY - This website receives no funding or any other form of award and is run voluntarily to provide information to those who want to trace the history of their house. We would like to say thank you to all those who have or will in future click on the advertisements they find on this page. We know they can be a nuisance or distraction and we try to make sure that they are relevant to the information we provide and our readers. However the modest income we receive from them keep the web site going. So thank you.